Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut et leo condimentum, commodo diam id, interdum ipsum. Sed tincidunt sem quis dui varius varius. Ut quam nisl, sagittis sed imperdiet at, vehicula sed nisl. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean ac aliquam velit. Pellentesque a volutpat leo. Etiam lacinia feugiat ante eu ultricies. Curabitur ut lectus et arcu pellentesque iaculis. Praesent varius diam metus, nec lacinia nisl tincidunt ac.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut et leo condimentum, commodo diam id, interdum ipsum. Sed tincidunt sem quis dui varius varius. Ut quam nisl, sagittis sed imperdiet at, vehicula sed nisl. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean ac aliquam velit. Pellentesque a volutpat leo. Etiam lacinia feugiat ante eu ultricies. Curabitur ut lectus et arcu pellentesque iaculis. Praesent varius diam metus, nec lacinia nisl tincidunt ac.

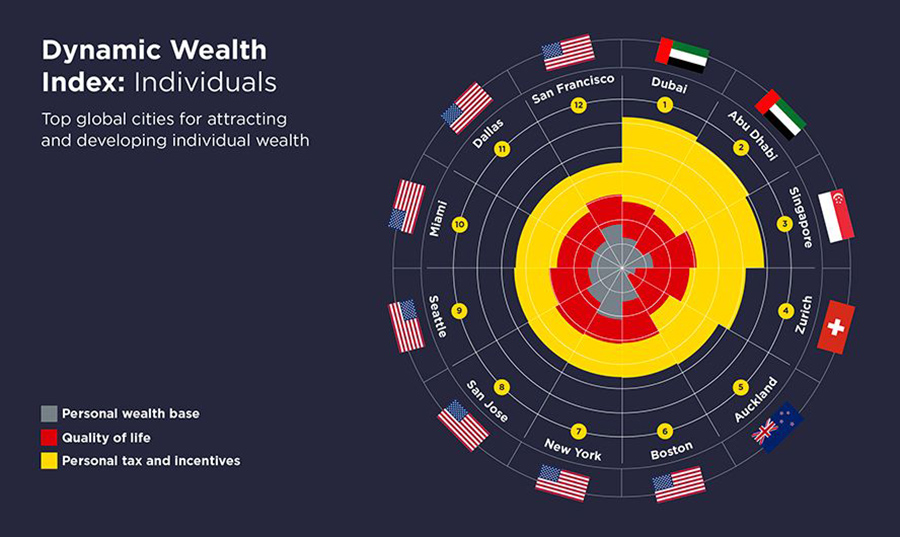

Wealthy individuals are increasingly weighing lifestyle and other subjective qualities alongside financial incentives when deciding where to settle in 2025. The UAE is an obvious choice for a number of reasons.

Straightforward factors like taxes and incentives are actively considered by HNWI just as much as factors like the unpredictable global geopolitical outlook. Factors like quality of life, culture, and climate are now intertwined with financial sweeteners and can often be deciding factors.

These factors come a long way in explaining why Dubai and Abu Dhabi rank as the top two cities for HNWIs to relocate to in the Savills study. When it comes to quality of life, it does not get much better than these two metropolises – they are highly regarded by the wealthy because they offer a huge array of luxury amenities.

Dubai takes first place mainly thanks to personal tax and incentives, according to the report from the real estate consultancy firm. Abu Dhabi ranks hot on Dubai’s heels, ahead of Singapore, Zurich, Auckland, and many of the top cities in the United States.

More than 6,700 super-rich individuals migrated to the UAE just last year. Many of those were multi-millionaires from the UK, who could theoretically go from paying up to 45% of their earnings in tax to paying nothing at all. That is because the UAE has no capital gains tax, no inheritance tax, and does not tax all dividends from investments.

There has also been a huge wave of Russian capital into the UAE, with many Russian millionaires choosing Dubai and Abu Dhabi as their home bases and a smart place to invest in real estate. Other reasons for the influx include the availability of 10-year golden visas and lax Covid-19 travel restrictions back during the pandemic.

This influx of mega-rich residents has had an effect on the local economy. Both the value and volume of real estate transactions have grown, with prime residential capital values rising by 6.8% in Dubai in 2024. There was also a 47% year-on-year increase in the number of residential real estate transactions last year.

“Against an increasingly changeable geopolitical and economic backdrop, global wealth flows are evolving, as HNWIs and businesses adapt their decisions on where to locate,” said Paul Tostevin, Director at Savills.

“Traditional predictors of global wealth flows, such as government policies, taxes and incentives, and the presence of either innovative talent pools or existing communities of similar individuals, have always been key drivers of dynamic footloose companies and individuals, and will continue to play a major role, but a sense of place, and a high quality of living, are progressively the deciding factor when making location decisions.”

pendisse et orci commodo quam gravida dictum.